In an era marked by increasing global mobility, understanding the nuances of citizenship-based taxation is crucial for high-net-worth individuals and global investors. This guide provides an in-depth look at the complexities and implications of citizenship-based taxation, highlighting its contrasts with residence-based taxation, exploring income tax-free countries, and offering insights into avoiding double taxation.

What is Citizenship-Based Taxation?

Citizenship-based taxation is a method by which a country taxes its citizens on their worldwide income, regardless of where they live or earn their income. This system contrasts with residence-based taxation, where individuals are taxed based on their residence within a country, irrespective of their citizenship.

What are Residence-Based Taxation and Territory-Based Taxation?

Residence-based taxation and territory-based taxation represent two alternative frameworks to the citizenship-based approach, each with distinctive implications for global individuals and investors.

Residence-based taxation levies taxes on all income earned by individuals who are considered tax residents (status that can be achieved without permanent residency) of the taxing country, regardless of where that income was earned.

Conversely, territory-based taxation focuses solely on taxing the income earned within the borders of the country, providing a potentially more favorable scenario for international income.

Individuals with high net worth or those operating on a global scale should carefully examine the benefits and drawbacks of each system. Understanding these differences is pivotal for effective tax planning and strategy, potentially impacting decisions on where to establish residency or domicile for tax purposes.

The choice among these systems can significantly affect overall tax liability, freedom of movement, and investment strategy, underscoring the importance of informed, strategic decision-making in the management of one's international affairs and assets.

Citizenship vs. Residence-Based Taxation: Key Differences

The main difference lies in the scope of tax obligations. Citizenship-based taxation subjects citizens to tax responsibilities on global incomes, while residence-based models tax individuals only on the income generated within that country's boundaries where they are tax residents. Understanding these differences is paramount to strategic financial planning for global investors and high-net-worth individuals.

How the U.S. Taxes Citizens Regardless of Where They Live

Unique among nations, the United States tax system, alongside Eritrea and a few others, employs citizenship-based taxation – obliging U.S. citizens and Green Card holders to file tax returns on their worldwide income, even if they are non-residents of the US. American citizens also have to report to the US government their foreign assets such as foreign bank accounts and

foreign sources of income.

This policy can lead to scenarios where individuals face the potential for double taxation on the same income.

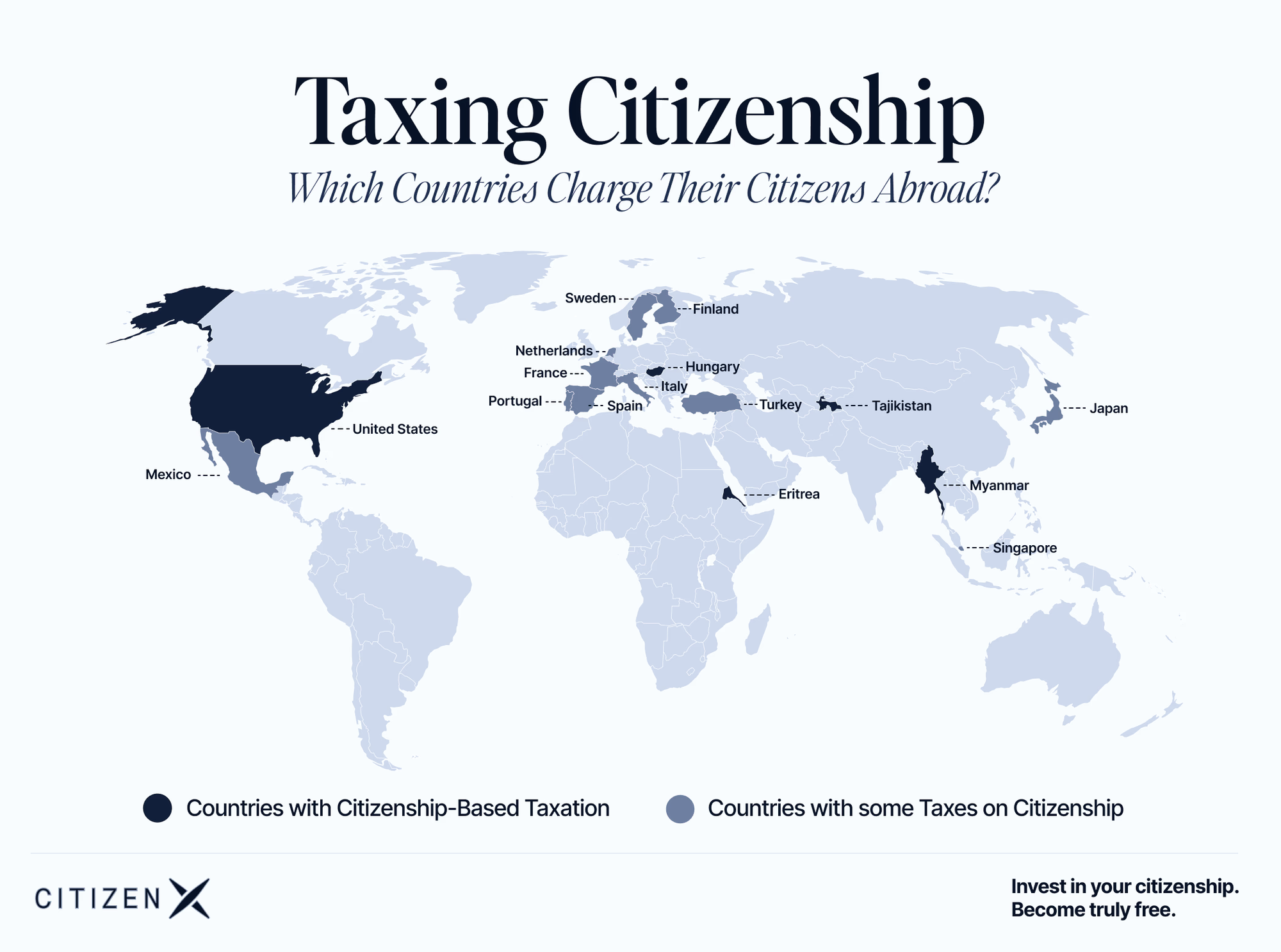

Do only the US and Eritrea employ citizenship-based taxation?

No, although the United States and Eritrea are often highlighted for their use of citizenship-based taxation, they are not the only countries that engage in this practice.

Contrary to common belief, several other nations have either attempted or are currently employing variations of citizenship-based taxation, including Myanmar, Hungary, and Tajikistan (active citizenship-based taxation) – and others that abolished this system, such as Mexico, Romania, Bulgaria, Vietnam, and the Philippines. These countries incorporate(d) citizenship-based taxation in diverse forms, ranging from taxing the worldwide income of citizens regardless of their residency status to imposing taxes on those working abroad for governmental entities or domestically headquartered companies.

It's imperative to recognize that while these countries have legislated for citizenship-based taxation, the enforcement and effectiveness of these laws vary greatly. For instance, Myanmar technically mandates taxes on all foreign income, excluding salaries; however, this law is not actively enforced. On a similar note, the Philippines previously utilized a modified income tax code targeting expatriate workers, but this was eliminated in the 1997 budget. In stark contrast, the US has established a robust system for taxing global income through mechanisms like the Foreign Account Tax Compliance Act (FATCA), underscoring its comprehensive approach to worldwide taxation.

Also, not everything is black or white when it comes to citizenship-based taxation, and there are countries with grey areas:

Finland imposes taxes on its citizens moving abroad for the first three years unless they sever all ties with Finland. After that, they are exempt from Finnish taxes.

In line with a 1963 treaty, France levies taxes on French citizens moving to Monaco, except for those who've lived in Monaco continuously since 1957, born there, or hold Monégasque nationality among other cases.

Italy taxes its citizens moving to tax havens as Italian residents unless they can prove they have no links to Italy.

Japan imposes inheritance and gift taxes globally for ten years post-residence termination, applicable to Japanese citizens and certain former residents.

Mexico taxes its citizens relocating to tax havens as Mexican residents for the first five years, after which they are exempt from Mexican taxes.

The Netherlands imposes inheritance and gift taxes on its citizens who move abroad for ten years as if they were still residing in the country.

Portugal taxes its citizens moving to tax havens as Portuguese residents for the first five years, after which they are exempt from Portuguese taxes.

Singapore mandates CareShield Life premium payments from its citizens and permanent residents born in 1980 or later, regardless of their place of residence. Additionally, Singapore requires its citizens and Permanent Residents to pay MediShield Life premiums regardless of their residence location, with an opt-out provision after five years of overseas stay.

Spain taxes its citizens relocating to tax havens as Spanish residents for the first five years, after which they are exempt from Spanish taxes.

Sweden imposes tax on its citizens (and foreigners there for at least ten years) moving abroad for the first five years unless they show no essential ties to Sweden, after which they're exempt from Swedish taxes.

Turkey collects taxes from its citizens working abroad for the Turkish government or companies as Turkish residents. However, income already taxed in the country of origin is exempted.

This exploration reveals that citizenship-based taxation is not exclusive to the US and Eritrea but is rather a broader phenomenon with varying degrees of application and enforcement worldwide. Understanding these nuances is critical for global investors and high-net-worth individuals navigating the complex landscape of international taxation.

EUROPEAN CITIZENS TO PAY GLOBAL TAXES

— Alex Recouso (@alexrecouso) August 8, 2025

🇫🇷 France approved an amendment to tax its citizens on global income if they move to a region with tax 50% lower than France's.

🇳🇱 The Netherlands proposed a new exit tax for citizens who leave the country to pay income (and presumably…

How to Avoid Double Taxation

The U.S. offers several mechanisms to mitigate the risk of double taxation, including foreign tax credits and the Foreign Earned Income Exclusion (FEIE). Tax treaties between the U.S. and other countries can also provide relief by defining tax liabilities and preventing income from being taxed by both jurisdictions. Using an expense tracking app can make this process far easier, allowing you to categorize transactions, monitor cross-border spending, and keep accurate records for both personal finance and tax compliance.

Do Tax Treaties Really Help US Citizens?

Tax treaties play a crucial role in defining how U.S. citizens are taxed on the income earned abroad, often reducing or eliminating the potential for double taxation. These agreements, however, vary by country, making it essential for individuals to consult with tax professionals to understand the specific terms and how they apply to their situation.

Countries with U.S. Totalization Agreements

Totalization agreements help U.S. expats and non-residents avoid dual social security taxation, determining which country has the right to tax an individual's earnings for social security purposes. The U.S. taxation system has established totalization agreements with several countries, offering clarity on exemptions and tax reliefs for workers and employers operating across borders.

Exploring Countries with No Income Tax

Several countries traditionally considered tax havens, including Monaco, Bermuda, and the Bahamas, attract high-net-worth individuals by offering no personal income tax on residents. For those with passports from countries with no citizenship-based taxation looking to optimize their tax liability, these destinations can be an attractive option to secure the absolute 0% tax.

However, these jurisdictions often rely on alternative taxation methods, such as sales taxes or duties, to fund government operations.

Where to Find Help and Guidance on Citizenship-Based Taxation

Navigating the intricacies of citizenship-based taxation requires expert advice. Consulting with experienced tax professionals who specialize in international tax laws can provide personalized guidance, ensuring compliance while optimizing tax strategies. Resources such as the IRS website and specialized tax advisory firms offer valuable insights and support.

Looking into the Future of Citizenship-Based Taxation

Given the prevailing global economic trends, with most countries facing challenges related to inflation and seeking to maximize revenue streams, it seems increasingly likely that more Western nations may consider the adoption of citizenship-based taxation models. This shift would represent a strategic attempt to safeguard national fiscal health by ensuring that citizens contribute taxes regardless of their place of residence. The trajectory toward more aggressive tax regimes, aimed at combating economic pressures and funding public services, suggests that governments may view citizenship-based taxation as a viable method to prevent tax base erosion and capture revenue from their globally mobile citizens.

Understanding citizenship-based taxation and its implications is crucial for effective financial planning for high-net-worth individuals and global investors. Leveraging tax treaties, residency benefits in income-tax-free countries, and strategies to avoid double taxation are essential. Additionally, obtaining a second passport and potentially renouncing citizenship of countries with citizenship-based taxation can be an effective strategy for asset protection and ensuring compliance with complex international tax laws. With expert guidance and a strategic approach, individuals can navigate citizenship-based taxation challenges, optimize taxes, and preserve wealth.